What’s the point of selling your invoices if you only receive a slice of what you’re owed? Traditional providers and banks usually offer 70-80%, i.e. For a £10,000 invoice, you will receive £10,000 minus fees. More money upfront – We offer a 100% advance rate on your invoices. We will never ask for payment when you’re not using the service.

With us, you know exactly how much you pay. Banks demand annual fees, a fee for not using the service, fees for listing new customers all of that on top of the interest and service charges. Low and transparent fees – On average, we charge 2.1% for a 30-day invoice. By the time it takes to get a meeting with your bank manager, you will have already financed your first invoices.

#Fast invoice factoring free#

With Investly, you have flexibility - you are free to choose which invoices and when to finance.

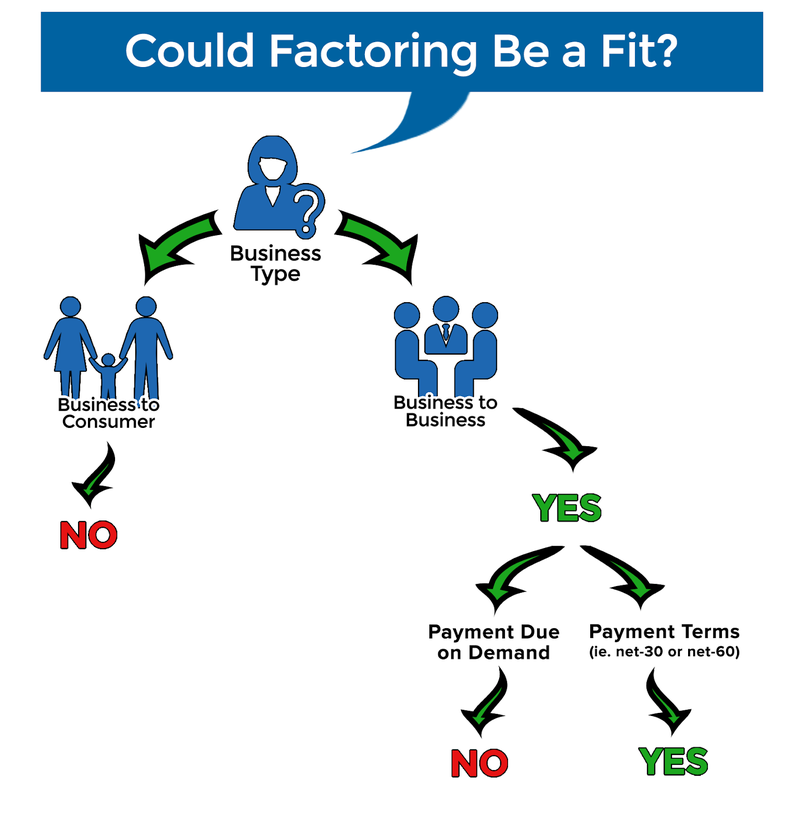

Investly finances your invoices thanks to community of investors and you receive 100% of the invoice value, minus a small fee. Wouldn’t it be nice to receive payment earlier than 6 weeks or 3 months? Invoice finance is the right solution. Landing a large customer or getting a huge order is good for business, but it can put extra pressure on your cash flow if your customer demands long payment terms.

Small businesses must absorb direct costs, labour and other expenses weeks or months before getting paid. Large companies are demanding longer payment terms than ever before.Īs an entrepreneur, you know that working capital (cash) is the lifeblood of your business. Small companies face an uphill battle - buyers leverage long-payment terms on invoices and banks are often unable to give businesses the access to the funds they need.

0 kommentar(er)

0 kommentar(er)